Ethereum price risks falling as whales dump $60 million ETH, sparking concerns of downward pressure, despite current price gains and optimistic market sentiment.

Ethereum price has regained momentum today, but the recent whale movements raise concerns over a potential slump ahead. According to recent reports, the whales have offloaded around $60 million in ETH to Binance and Coinbase, hinting that the crypto might face downward pressure ahead. However, some have also argued that the investors might be taking advantage of profit-booking opportunities ahead of the price recovery.

Ethereum Price Likely To Dip Amid Whales’ Massive Dump

The whales have offloaded 22.67K ETH recently, which some view as profit-booking opportunities taken by the investors. According to whale alert, an ETH whale, identified by the wallet address “0x435…913ab” has offloaded 10K ETH, valued at around $26.1 million, to Binance. Arkham Intelligence showed that this address is linked to the Gnosis Safe Proxy address marked as the Metalpha.

Simultaneously, another whale with wallet address “0x968…3c625” sent 12,675 ETH, worth about $33.10 million, to the Coinbase exchange. The recent transfers to these top crypto exchanges have fueled concerns over a potential downturn in the crypto market in the coming days.

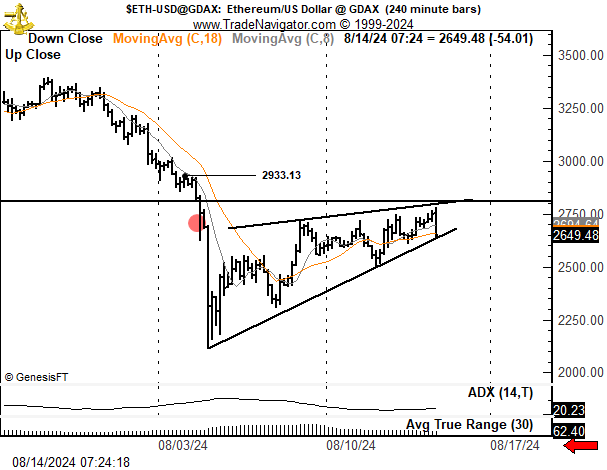

Meanwhile, in a recent X post, crypto market expert Peter Brandt has taken a bearish stance on Ethereum price, citing a completed 5-month rectangle pattern and a rising wedge on the intraday chart. Looking at the recent chart pattern, he has set a target of $1651, indicating a potential drop from current levels.

However, Brandt emphasizes that patterns can fail more than 50% of the time, but his analysis suggests a high-risk short opportunity. In addition, he also said that if ETH moves above $2961, he will exit the trade.

ETH Soars Defying Market Expectations

Despite the recent uncertainties among investors, the second-largest crypto market cap has soared today. However, a recent Ethereum price analysis indicates that if the crypto fails to soar past the $2,618 level, it could potentially dip to $2,190.

As of writing, ETH price was up 1.72% to $2,609, with its one-day trading volume dropping about 41% to $9.28 billion. Over the last 24 hours, the crypto has touched a low of $2,556.22, indicating the volatile scenario hovering in the market.

Meanwhile, the recent whale transfers have raised discussions over its potential implications on the crypto’s price. However, looking at the cooling inflation figures and the recent price action, it appears that investors are putting their bets on the crypto, given its future growth potential.

In addition, the optimism over the Ether ETF has also bolstered market confidence. Vance Spencer, Framework Ventures co-founder, has recently said that Ethereum ETF is likely to grab 50% of the total Bitcoin ETF influx.

To read article in Arabic, please visit the website Crypto Mena

Risk Disclaimer

Although Sponsored Trading can be profitable, it is associated with a significant risk of losing your investment. The risks will increase when trading on margin companies. Traders must exercise due diligence and be careful when making their trading decisions. It is the sole responsibility of the Trader to learn and acquire the knowledge and experience required to use the Trading Platform and anything that will be required to trade properl